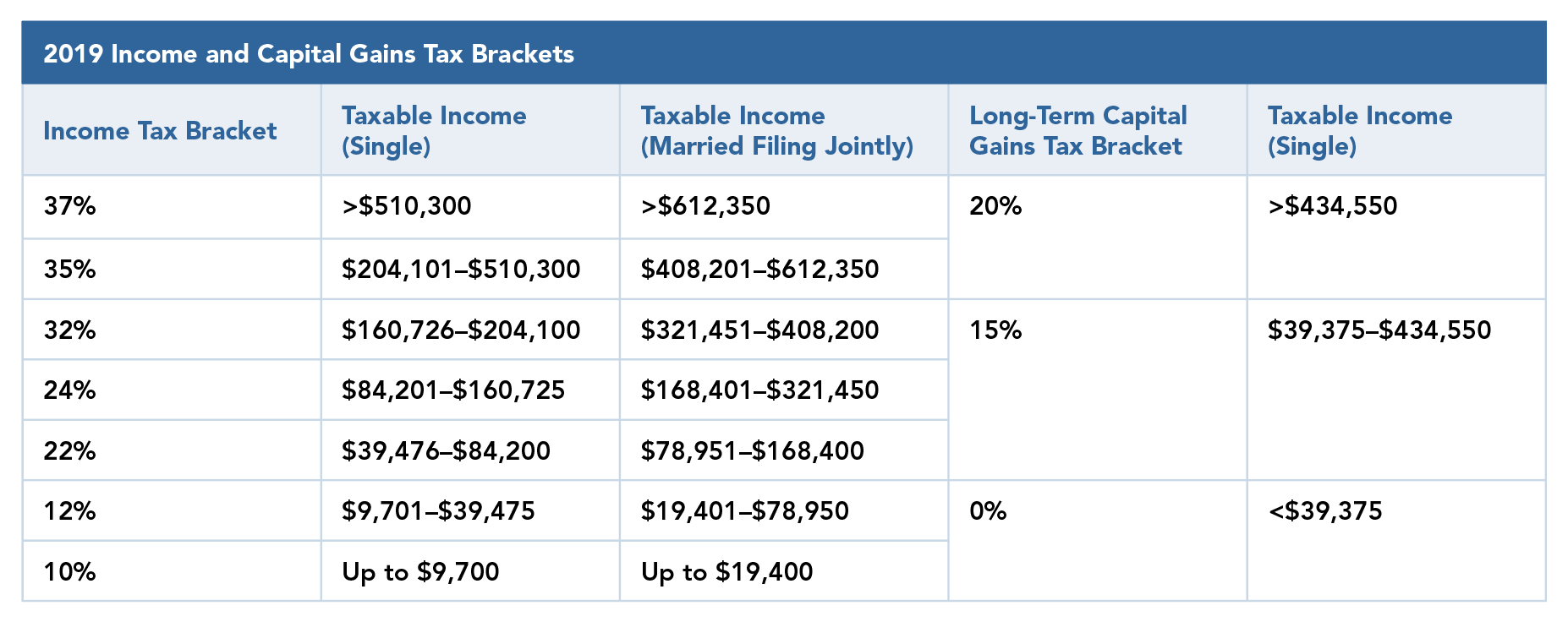

Capital Gains Tax 2024/25 Uk Time. This is the amount of profit you can make from an asset this tax year before any tax is payable. For the 2023/2024 tax year capital gains tax rates are:

This measure changes the capital gains tax ( cgt) annual exempt amount ( aea ). The rate of capital gains tax depends on whether you’re a basic, higher or additional rate taxpayer, as well as the type of asset disposed of.

There Is No “One Size Fits All” Capital Gains Tax Calculation And Much Will Depend On How You Owned / Lived In The Property, The Amount Of Gain, Your.

Uk capital gains tax rates.

With Shifts In Tax Allowances.

Read our guide to learn how you could legally reduce your capital gains tax bill.

Capital Gains Tax 2024/25 Uk Time Images References :

Source: vickyqrobena.pages.dev

Source: vickyqrobena.pages.dev

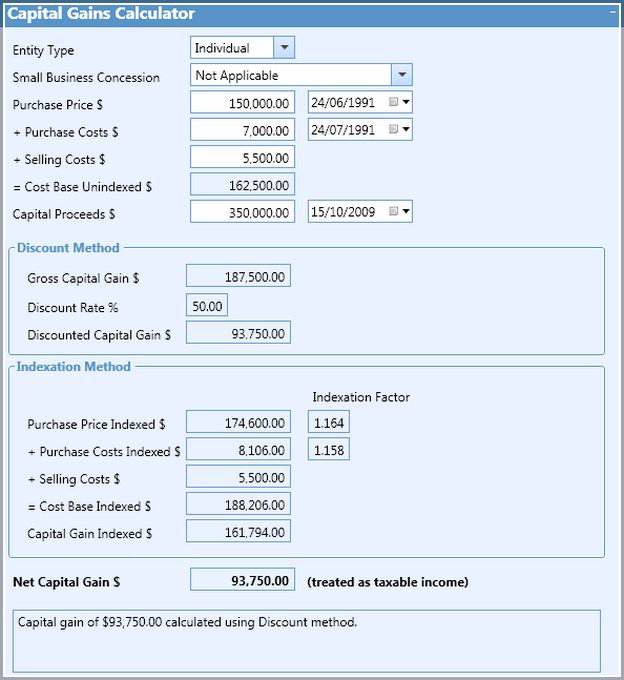

Capital Gains Tax Calculator 2024 Uk Elisha Chelsea, Read our guide to learn how you could legally reduce your capital gains tax bill. The fiscal year 2024/25 brings with it some changes and considerations for investors and property owners alike, especially capital gains tax (cgt).

Source: cindraqcarolann.pages.dev

Source: cindraqcarolann.pages.dev

Uk Capital Gains Tax Rates 2024 2024 Elga Nickie, For the 2023/2024 tax year capital gains tax rates are: The fiscal year 2024/25 brings with it some changes and considerations for investors and property owners alike, especially capital gains tax (cgt).

Source: leighawann.pages.dev

Source: leighawann.pages.dev

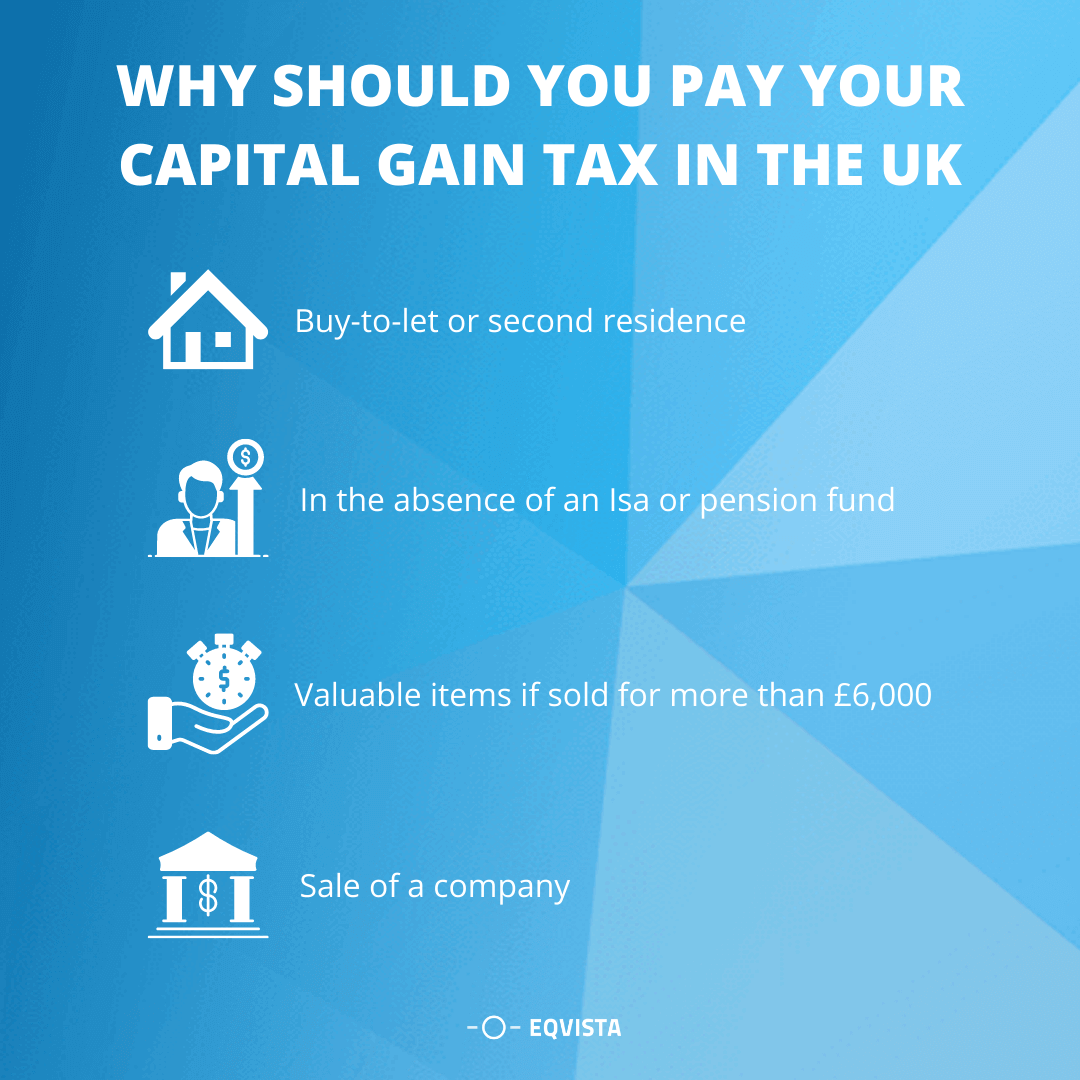

Uk Capital Gains Tax 2024 Korie Mildred, The uk budget 2024's adjustments to capital gains tax (cgt) are not merely technical tax reforms; When you earn more than £3,000.

Source: daciebroseanna.pages.dev

Source: daciebroseanna.pages.dev

Capital Gains Tax Rate 2024 Calculator Uk Hildy Karrie, For the tax year 2023 to 2024 the aea will be £6,000 for individuals and. This is the amount of profit you can make from an asset this tax year before any tax is payable.

Source: aureliawdaryl.pages.dev

Source: aureliawdaryl.pages.dev

ShortTerm Capital Gains Tax Rate 2024 Alina Caressa, Because the combined amount of £29,600 is less than. The uk budget 2024's adjustments to capital gains tax (cgt) are not merely technical tax reforms;

Source: devinajillana.pages.dev

Source: devinajillana.pages.dev

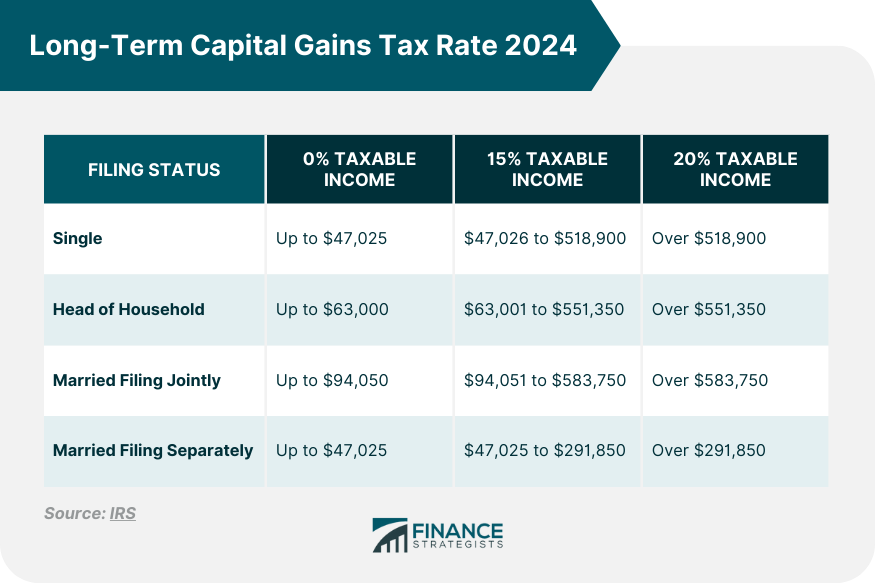

Irs Capital Gains Tax Rates 2024 Hannah Merridie, When you sell an asset, profit below this threshold is free from capital gains tax. For the 2024 to 2025 tax year the allowance is £3,000, which leaves £9,600 to pay tax on.

Source: danyamarisa.blogspot.com

Source: danyamarisa.blogspot.com

Stocks capital gains tax calculator DanyaMarisa, With shifts in tax allowances. Capital gains tax is a tax on the profit when you sell (or ‘dispose of’) something (an ‘asset’) that’s increased in value.

Source: reneebchristiane.pages.dev

Source: reneebchristiane.pages.dev

Tax Tables 2024 Irs For Capital Gains Vanda Miranda, You can use the service to report gains on assets you sold during the tax year: The rate of capital gains tax depends on whether you’re a basic, higher or additional rate taxpayer, as well as the type of asset disposed of.

Source: www.financestrategists.com

Source: www.financestrategists.com

Capital Gains Tax Rate 2024 Overview and Calculation, It’s the gain you make that’s taxed, not the amount of money. When you earn more than £3,000.

Source: imagetou.com

Source: imagetou.com

Capital Gains Tax Allowance 2024 25 Shares Image to u, Capital gains tax is a tax on the profit when you sell (or ‘dispose of’) something (an ‘asset’) that’s increased in value. The rate of capital gains tax depends on whether you’re a basic, higher or additional rate taxpayer, as well as the type of asset disposed of.

The Fiscal Year 2024/25 Brings With It Some Changes And Considerations For Investors And Property Owners Alike, Especially Capital Gains Tax (Cgt).

The uk budget 2024's adjustments to capital gains tax (cgt) are not merely technical tax reforms;

For The 2023/2024 Tax Year Capital Gains Tax Rates Are:

Gains made on disposals of residential property that do not qualify for prr are chargeable to cgt at 18% for any gains that fall within an.

Posted in 2024